The Academy for Modern Lending.

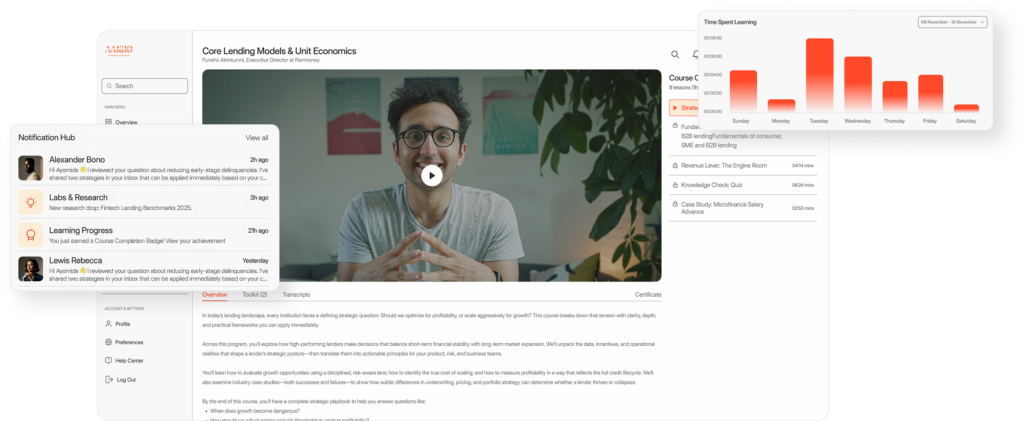

The Aakkio Academy offers short, impactful courses on lending, collections, growth, and financial operations — designed for professionals building the future of finance.

Strategy & Growth

Core Lending Models & Unit Economics

This course breaks lending down to its core, covering key models, revenue drivers, and how to balance growth with profitability to align your lending strategy with your goals.

Course Content.

Core Lending models and unit economics

- Strategic Direction; Profit vs Growth

- Fundamentals of consumer, SME and B2B lending

- Revenue Lever: The Engine Room

- Knowledge Check: Quiz

- Case Study: Microfinance Salary Advance

Product Development & Design for Lenders

Course Content.

Product Development and Design for Lenders

- Product Strategy Development: Building Blocks

- End-to-End Product Development Playbook

- Product Paper (PRD) for Lenders — Your Product’s Blueprint

- Testing & Product Rollout (Alpha → Beta → Full Launch)

- Knowledge Check: Quiz

- Case Study: Testing & Rolling Out a Lending Product

GTM & Growth Hacking for Loan Products

Course Content.

GTM & Growth Hacking for Loan Products

- What GTM means for lenders

- Funnel Strategy and Visualization (Macro View)

- GTM/Acquisition Strategy for Lenders

- Tracking and Attribution

- GTM Economics – The numbers that matter

- Channel profitability comparison (Segmented view)

- Cohort Improvement Analysis (Time Series View)

- Benchmarks for healthy GTM Economics

- Knowledge Check: Quiz

- Case Study: LendaSure’s Growth Paradox

Digital Campaigns & SEO for Loan Products

Course Content.

Digital Campaigns and SEO for Loan Products

- Digital Campaign Strategy & Execution

- SEO & Content Strategy

- Technical SEO – The Foundation

- Content SEO: What to Write and How

- Link Building and Authority Growth

- Tracking SEO Performance

- The SEO Flywheel

- Knowledge Check: Quiz

- Case Study: Credia Finance — Paid Ads vs. Organic Momentum

Leadership & Transformation

Core Lending Models & Unit Economics

This course breaks lending down to its core, covering key models, revenue drivers, and how to balance growth with profitability to align your lending strategy with your goals.

Course Content.

Core Lending models and unit economics

- Strategic Direction; Profit vs Growth

- Fundamentals of consumer, SME and B2B lending

- Revenue Lever: The Engine Room

- Knowledge Check: Quiz

- Case Study: Microfinance Salary Advance

People & Productivity in Lending

Course Content.

People & Productivity in Lending

- How Lending Organisations Are Structured

- Hiring the Right People for the Right Seats

- Managing People and Setting Performance Expectations

- Motivating, Incentivising, and Retaining Teams

- Leadership and Culture in Lending Organisations

- Building Productive Systems and Processes

- Sales and Field Team Productivity

- Integrating People, Data, and Performance

- Knowledge Check: Quiz

- Case Study: Comparing Field vs. Digital Collections Team Productivity

Risk & Collections

Credit Risk Management 101

Course Content.

Credit Risk Management 101

- Why Credit Risk Management Matters

- Credit Risk Frameworks

- Credit Scoring Models

- Credit Policy Design

- Risk-Adjusted Pricing

- The Management Credit Committee (MCC)

- Knowledge Check: Quiz

- Case Study: B2C vs B2B Risk Assessment

Lending & Credit

Credit Risk Management 101

Risk is central to lending. This course covers how lenders assess, price, and control credit risk—using credit policies, scoring models, and risk-adjusted pricing to protect against losses while supporting growth.

Course Content.

Credit Risk Management 101

- Why Credit Risk Management Matters

- Credit Risk Frameworks

- Credit Scoring Models

- Credit Policy Design

- Risk-Adjusted Pricing

- The Management Credit Committee (MCC)

- Knowledge Check: Quiz

- Case Study: B2C vs B2B Risk Assessment

Product Development & Design for Lenders

Course Content.

Product Development and Design for Lenders

- Product Strategy Development: Building Blocks

- End-to-End Product Development Playbook

- Product Paper (PRD) for Lenders — Your Product’s Blueprint

- Testing & Product Rollout (Alpha → Beta → Full Launch)

- Knowledge Check: Quiz

- Case Study: Testing & Rolling Out a Lending Product

Operations, Legal & Compliance

Financial Operations for Lenders

This course explores how to design and scale effective collections—covering recovery strategies, performance tracking, and digital tools through practical frameworks and case studies.

Course Content.

Financial Operations for Lenders

- Understanding the Financial Backbone of a Lending Business

- Treasury Management for Lenders

- Bookkeeping and Financial Records Management

- Reconciliation and Financial Integrity

- Tax Management for Lenders

- Management & Regulatory Reporting

- Financial Controls, SOPs, and Governance

- Technology & Automation in Financial Operations

- Putting It All Together – Financial Ops Playbook

- Knowledge Check: Quiz

- Case Study: Reconciling Loan Repayments via Bank APIs

Legal, Governance & Compliance in Lending

Course Content.

Legal, Governance & Compliance

- Legal Foundations of Lending

- Regulatory Landscape

- Governance Structures in Lending Institutions

- Credit Policy & Legal Documentation

- Data Privacy, Consumer Protection & Digital Lending Ethics

- Anti-Money Laundering (AML) & Know Your Customer (KYC)

- Debt Recovery & Legal Enforcement

- Compliance Framework & Audit Readiness

- Emerging Legal & Governance Themes

- Case Studies & Practical Simulations